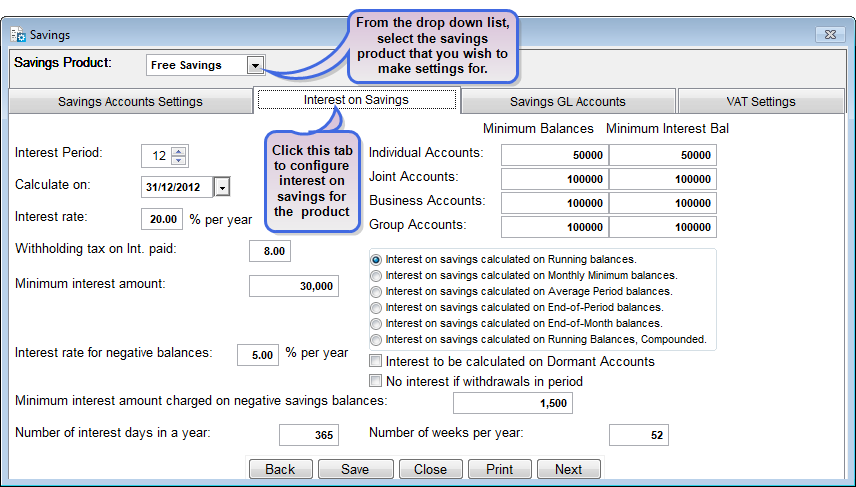

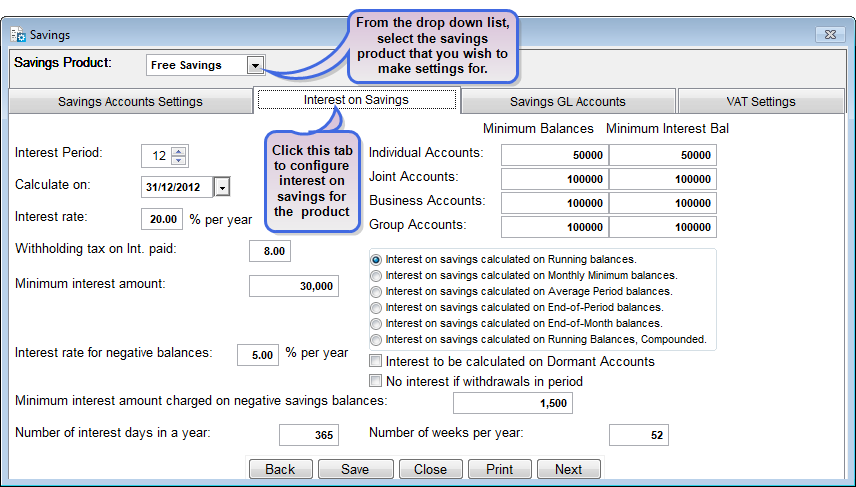

The savings interest configuration menu lets you set the parameters that will be applied during the various savings interest transactions for different savings products.

How to configure Savings Interest Settings

To make savings interest settings you go to System->Configuration->Savings-> and click on the Interest on Savings tab. A screen will appear looking as follows:

1) Interest on savings calculated on Daily Running balances: In this case the interest is calculated as follows:

SUM(End of the day balance x No. of days since the last transaction/No. of interest days per year) x Annual Interest Rate

For example, if the following balances were on the client's account in the month of January 2012:

01/01/2012 - 14/01/2012: 300,000 (deposit of 300,000 made on 01//01/2012)

15/01/2012 - 19/01/2012: 200,000 (withdrawal of 100,000 made on 15/01/2012)

20/01/2012 - 31/01/2012: 100,000 (withdrawal of 100,000 made on 20/01/2012)

The Annual Interest Rate is 10% and the number of interest days in a year is 365 then the interest on the client's savings for the month of January would be:

{(300,000 x 14/365) + (200,000 x 5/365) + (100,000 x 12/365)} x 10% = 1753.42

2) Interest on savings calculated on Monthly Minimum balance:In this case the interest is calculated as follows:

(Monthly Minimum balance x Annual Interest Rate)/Number of months in a year

Please note that if the interest on savings is calculated on monthly minimum balances the interest for the month in which the client made his/her first deposit will be "zero" (since the minimum balance of the client's account for that month is "zero").

Therefore for the above example, if the first deposit was made on 01/01/2012, the interest on the client's savings for the month of January would be:

(0 x 10/100)/12 = 0

If in the above example we will change the first deposit date to be 31/12/2011, hence the 300,000 will be the balance carried forward from the month of December, then the Interest on the Minimum Balances for January will be:

(100,000 x 10/100)/12 = 833.33

3) Interest on savings calculated on Average Monthly balance: In this case the interest is calculated as follows:

(((Balance at the Start of the Month + Balance at the End of the Month)/ 2) x Annual Interest Rate)/Number of Months in a Year)

Please note that if the Balance at the Start of the period for the above example will be equal to 0 (the first deposit is made on the 1st day of the period, therefore the starting balance is 0).

Therefore for the above example, if the first deposit was made on 01/01/2012, the interest on the client's savings for the month of January would be:

(((0+100,000)/ 2 x 10%)/12) = 416,62

4) Interest on savings calculated on End-of-period balance:In this case the interest is calculated as follows:

((End of period balance x Annual Interest Rate / 100)/Number of month in a year) x Number of month in the period

Therefore for the above example, the interest on the client's savings for the month of January would be:

((100,000 x 10%)/12) x 1 = 833.33

5) Interest on savings calculated on End-of-month balance: In this case the interest is calculated as follows:

(Balance at the end of the month x Annual Interest Rate)/12

Therefore for the above example, the interest on the client's savings for the month of January would be:

(100,000 x 10%)/12 = 833.33

6) Interest on savings calculated on Running balances compounded: In this case the interest is calculated as follows:

Running balance x (No. of days since the last transaction/No. of interest days per year ) x Annual Interest Rate / 100

For example, if the following balances were on the client's account in the month of January :

01/01/2012 - 14/01/2012: 300,000 (deposit of 300,000 made on 01//01/2012)

15/01/2012 - 19/01/2012: 200,000 (withdrawal of 100,000 made on 15/01/2012)

20/01/2012 - 31/01/2012: 100,000 (withdrawal of 100,000 made on 20/01/2012)

The annual Interest Rate is 10% and the number of interest days in a year is 365 then the interest on the client's savings for the month of January would be:

(300,000 x 14/365 x 10%) = 1150.685. This is added to the principal (300,000 + 1150.685) hence the new running balance is 301,150.685

When a withdrawal of 100,000 is made the running balance on 15/01/2012 is 201,150.685

Interest is calculated as (201,150.685 x 5/365 x 10%) = 275.55 . The new running balance is 201,426.235

When another withdrawal is made on 20/01/2012. The balance was 101,426.235. Interest is calculated on 101,426.235 as:

(101,426.325 x 12/365 x 10/100) = 333.46

The running balance inclusive of interest at the end of January is 101759.785

Click on the Save button to save the parameters. You can click on the Print button to view/print these parameters and keep them for future reference.

Click on the Close button to exit.

The Nº 1 Software for Microfinance